The Streaming TV Playbook has been introduced to establish a structured and regulated framework, thereby mitigating the complexities previously associated with ad sales, content provision, and viewer experience.

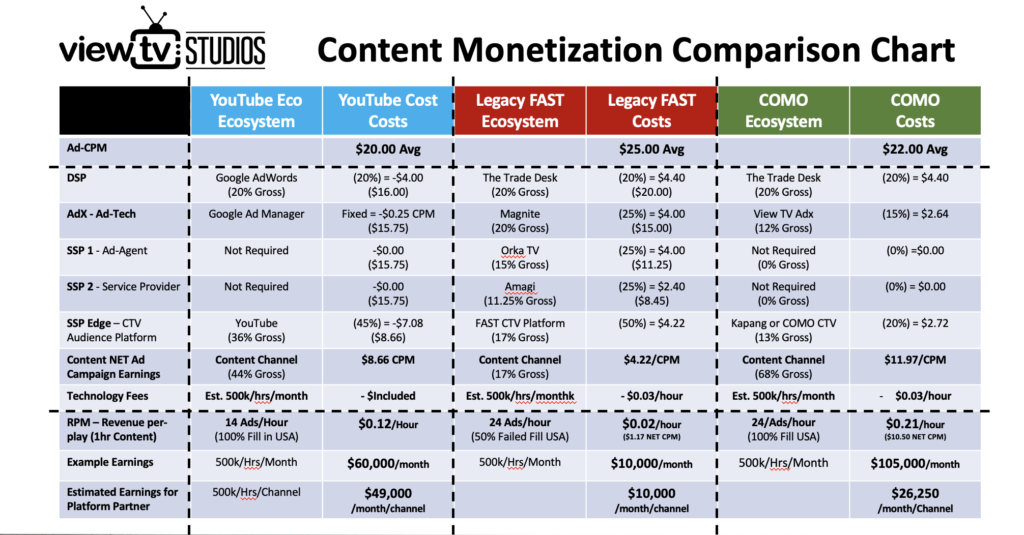

By simplifying the outdated legacy FAST approach to streaming TV and monetization, this playbook has effectively reduced intermediary technology costs, doubled ad yield, and provides a sustainable business model. This model facilitates the transition of existing linear television broadcasters to streaming television delivery and on-demand content monetization.

Utilizing a standardized package of technology tools and a structured revenue model, it empowers broadcasters and content owners to take control of their business models, aligning them with their investment strategies.

Why did we create the STREAMING Playbook

In the rapidly evolving landscape of digital content distribution, Free Ad-Supported Streaming Television (FAST) channels have emerged as a popular model. However, from a business standpoint, these channels are increasingly seen as unfit for purpose in content monetization. They often serve as unregulated cash machines for technology companies, exploiting content creators without providing fair compensation. This article examines the shortcomings of FAST channels and introduces the innovative COMO model by View TV Studios, which promises a more equitable approach to content monetization.

The Problem with FAST Channels

FAST channels operate on an ad-supported model, offering free content to viewers while generating revenue through advertisements. While this model appears beneficial on the surface, it is fraught with issues:

1. Lack of Regulation: The FAST ecosystem is largely unregulated, allowing technology companies to dominate the revenue streams. This often leaves content creators with minimal compensation.

2. Multiple Intermediaries: The presence of numerous intermediaries, such as Supply-Side Platforms (SSPs) and ad-tech providers, further dilutes the revenue that reaches content creators.

3. Unsustainable Revenue Models: Traditional broadcasters and premium content owners find the FAST model unsustainable due to its inability to provide consistent and fair revenue.

The COMO Model: A New Approach

View TV Studios has introduced the COMO (Content Monetization) model, which redefines the streaming playbook by providing a structured and fair revenue distribution system. This model is inspired by the proven success of YouTube’s monetization strategies and adapts them for broadcasters and content studios adopting Connected TV (CTV) and CTV distribution.

1. Simplified Stakeholder Roles: The COMO model outlines clear roles and responsibilities for all stakeholders, ensuring transparency and accountability in revenue distribution.

2. Fair Revenue Sharing: By eliminating multiple intermediaries, the COMO model ensures that a larger share of the revenue goes directly to content creators. This approach is designed to be as lucrative for studios as YouTube is for individual creators.

3. Sustainable Business Model: The COMO model provides a sustainable framework for content monetization, addressing the high costs of content creation while ensuring profitability for all parties involved.

Benefits of the COMO Model

1. Higher Revenue for Content Owners: The COMO model promises game-changing revenues for content owners, making studio content monetization as lucrative as YouTube for individual creators.

2. Reduction of Intermediaries: By cutting out unnecessary intermediaries, the COMO model increases the efficiency of revenue distribution and reduces the overall costs associated with content monetization.

3. CTV Platform Uplift: Platforms adopting the COMO model can benefit from a more attractive revenue share, with a 20% share potentially being worth three times more than the 50% offered by FAST channels.

Conclusion

The COMO Streaming Playbook by View TV Studios represents a much-needed reinvention of ad-funded content monetization for broadcasters and content studios. By addressing the failures of the unregulated FAST ecosystem, the COMO model offers a fair, transparent, and sustainable approach to content monetization. This innovative model not only ensures higher revenues for content creators but also provides a more equitable distribution of profits, paving the way for a more balanced and profitable digital content landscape.

How do I get a copy of the Streaming Playbook?

Fill out the form below to get hold of the COMO Approach Streaming TV Playbook from View TV: