Ah, FAST channels. The supposed saviors of content monetization. But let’s be honest, they’re about as effective as a chocolate teapot at content monetization. The programmatic ecosystem is the real culprit here, turning what could be a streamlined process into a convoluted mess, but others are also at fault.

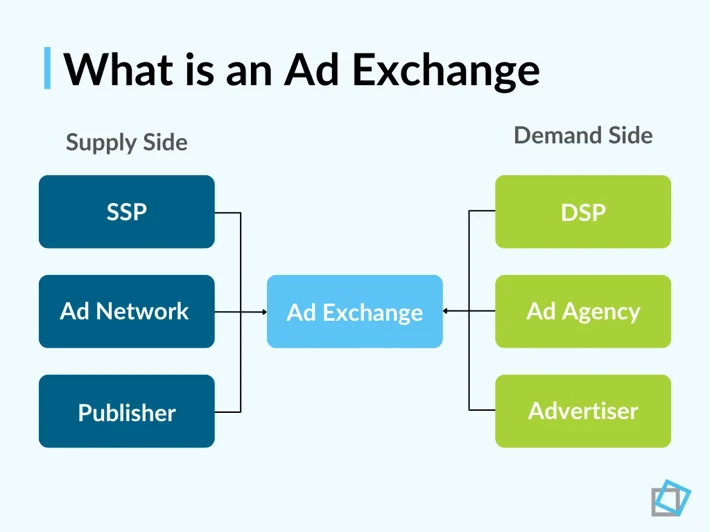

Imagine this: you’ve got representatives for technology as an ad-exchange, another lot for ad sales (DSP), and yet another for content owners, publishers, and channels (SSP). It’s like having a football team where every player insists on being the captain. The result? A chaotic ad sales chain with zero transparency and the lionshare of the money being taken away preferentially.

How have people not reacted to the failure of FAST? Is it simply a difficult truth they want to avoid, a problem that they choose to eternally lock away?

Don Cardone – View TV

And then there’s the ad-fill rate. Or should I say, the lack thereof. Thanks to the so-called technological wizardry of companies like Amagi, OTTera and Wurl, less than a third of ad opportunities are filled regularly. That’s right, two-thirds of potential revenue just vanishes into thin air. Brilliant, isn’t it?

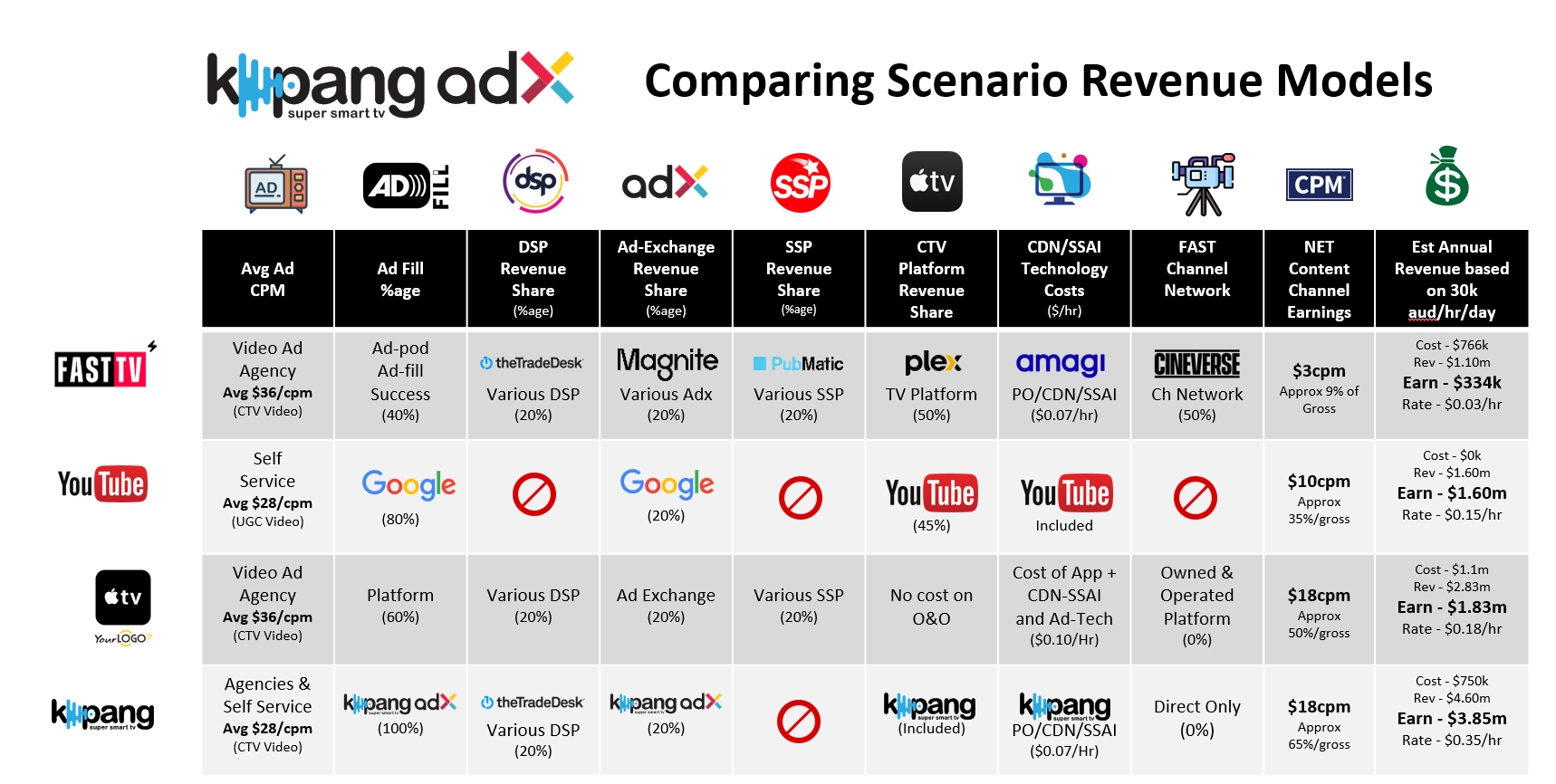

But wait, there’s more. With so many hands in the ad-sales pie, less than half of the ad revenue is left for the platforms like Vizio or Samsung Plus. They end up taking half as a joint venture, leaving content creators with scraps. Agencies like FASTChannels.tv, SoFAST and Cineverse are raking in tech fees and giving back a pittance. It’s a wonder anyone with content bothers with FAST at all.

Jamie Branson and his team at View TV, the realistic content monetization experts, have traced the revenue back and found that FAST is three times less profitable than simply putting your content on YouTube. And YouTube doesn’t charge you extra for the tech, quite a statement from View TV who charge for their cloud. Yet, media consultanty agencies are charging companies through the nose for consulting on this flawed model, why? Only a handful, like View TV, have actually audited the revenue model and either left the industry or seen an oppertunity to fix it FAST.

Jamie discovered that stakeholders in the programmatic cycle are making a tidy sum, so the cash exists, each pocketing around 20% of all ad deals without any responsibility for filling 100% of the ads. Some SSPs are earning $2m-$4m per month with a 30% gross profit, all while content owners, who take the real risks, get peanuts.

So, how has FAST been around so long? Because so-called FAST Masters and experts are promoting it without reviewing or reporting on the revenue model, it is a Gold Rush and most people have an art of selling pans and shovels. Content owners are lured into FAST Agency deals with promises of zero costs and 50% revenue shares, but the reality is far bleaker. Companies like Cineverse, SoFAST and FASTChannels.tv are more interested in raising funds than monetizing content., grabbing content and badly curating audience experiences that audiences hate and selling the TV Network dream to multiple Venture Capital firms.

Jamie Branson’s findings were a wake-up call for JBTV, they were with Invincible Entertainment, earnings zero dollars over two years for they 4,000 hour content library. They moved JBTV to View TV this month, which created Kapang as the consumer platform for Content Studios and Broadcasters.

Kapang has made some bold statements. They’ve ditched the FAST label and are promoting STOP (Streaming Television Outdated Performance) – a strategy to end the madness for Content Owners and reset the views on the Future of Television and Content Monetization. Kapang’s CoMo (Content Monetization) model promises two-thirds of gross ad revenues to content owners, putting them in charge of their monetization business. They’ve even rolled out a SaaS model that gives 100% of ad revenues back to broadcasters and content studios if they have existing large audience reach.

So, the truth about FAST? It’s making ad-tech providers richer and content studios poorer. Engage with Kapang and turn your content libraries into gold mines. Six times more revenue than traditional FAST and more than twice that of YouTube with a 100% ad-fill guarantee and 28-day payment terms. Can this be beaten? I think not.

So what is the Future of TV and the future of Streaming Television, Linear and On-Demand

The future of television and premium studio content, whether it’s the latest blockbuster or a hidden gem from the archives, needs to step up and replace the traditional movie theatre experience. We’re talking about a model akin to the classic 80/20 deals that theatres have had with studios for donkey’s years.

Enter Kapang, charging ahead like a bull in a china shop, determined to get content factories back in action. They’ve got a slew of monetization solutions that strike a fair balance between studios, tech, and audiences, ensuring everyone walks away with a smile. To pull this off, the ad-sales and subscription revenue processes need to respect both broadcasters and content studios. Kapang has laid down a fair option and is banking on its open-source approach catching on with other platforms.

Kapang isn’t just stopping there. They’re making their ecosystem technology available to multiple platforms through their tech company, View TV, as a product called View TV Cloud. This means other app-based TV and video platforms can offer top-notch service to audiences and content studios in just a few days, all thanks to a simple SaaS model.

The future is bright, but is certainly is not orange.

Written by The Real FAST Experts:-

Don Cardone – View TV USA – don.cardone@viewtvx.com

Stephan James – View TV Europe – Stephan.James@viewtvx.com

October 2024

Discover more from Rathergood

Subscribe to get the latest posts sent to your email.