Big Streaming Wars in all of Hollywood’s earth scorched streaming wars welcome one of the strangest battles.

Tune into TNT or Discovery Channel and chances are you might come upon an ad for a new streaming selection on Peacock or Netflix. Stream something on Max — also owned by the TV networks’ parent, Warner Bros. Discovery — and you’ll see no such thing. Nor are you likely to see commercials for something new from Amazon’s Prime Video on Disney+ or Hulu, though it’s certainly possible such promotions might turn up on some of the TV networks also owned by Disney, such as ABC or ESPN. And chances are virtually nil at the current moment that you’ll see anything touting Paramount+ or Tubi on the new ad-supported tier backed by Netflix.

Many of the companies that own streaming services have shown a new appetite for advertising. But they aren’t hungry enough, it seems, to accept advertising that might tout a piece of content available on a rival service. Netflix, Max and Disney’s Hulu and Disney+ do not accept ads that tout rival streaming services or the shows that run on them, according to executives familiar with the policies. And Paramount+, part of Paramount Global, tends to accept ads only from streaming competitors with whom the company might already do business, according to a person familiar with the situation.

Not everyone feels the same way. NBCU’s Peacock will take ads from rivals, and so will Amazon’s Freevee, according to people familiar with those companies’ policies.

Netflix, Amazon, NBCUniversal, Paramount Global, Walt Disney and Warner Bros. Discovery decllined to make executives available for comment. A spokesperson for Fox’s Tubi declined to respond to a query seeking information about that streamer’s policies regarding ads from broadband opponents.

In an era when media companies are frantically working to sign new subscribers, an ad for an adversarial streaming service, so the thinking goes, is tantamount to giving them a reason to exit. Paramount, Disney, Warner, Fox and NBCUniversal are under tremendous pressure to demonstrate not only subscriber growth, but an increase in hours spent with their individual services. Running ads for opponents only complicates those efforts.

The media companies appear to be ripping a page from old playbooks. For years, TV networks like ABC, CBS and NBC got nervous about running commercials that touted their rivals’ wares. In 1997, actor Dennis Franz played a surly cop in a spot for General Motors’ Cadillac — much like the one he depicted at the time on ABC’s “NYPD Blue.” The disposition of the commercial character was so similar to the one in the police drama that NBC and CBS refused to run the ad. In 2004. NBC’s TV stations yanked an ad out of rotation that told viewers they should watch reruns of the missing-persons drams “Without A Trace” on TNT. The catch? The ads ran during “E.R,” which was broadcast at the same time as new episodes of “Trace” on rival CBS.

But such efforts may not be sustainable in TV’s new world. “If anybody is going to promote programming, it should be for their own resources and their own families of studios and channels. God forbid you want to give anybody the hint of a suggestion that there might be another show in some other streaming universe,” says Tim Hanlon, who advises media and marketing companies as CEO of The Vertere Group. Still, he adds, sticking to that policy “is going to get complicated.”

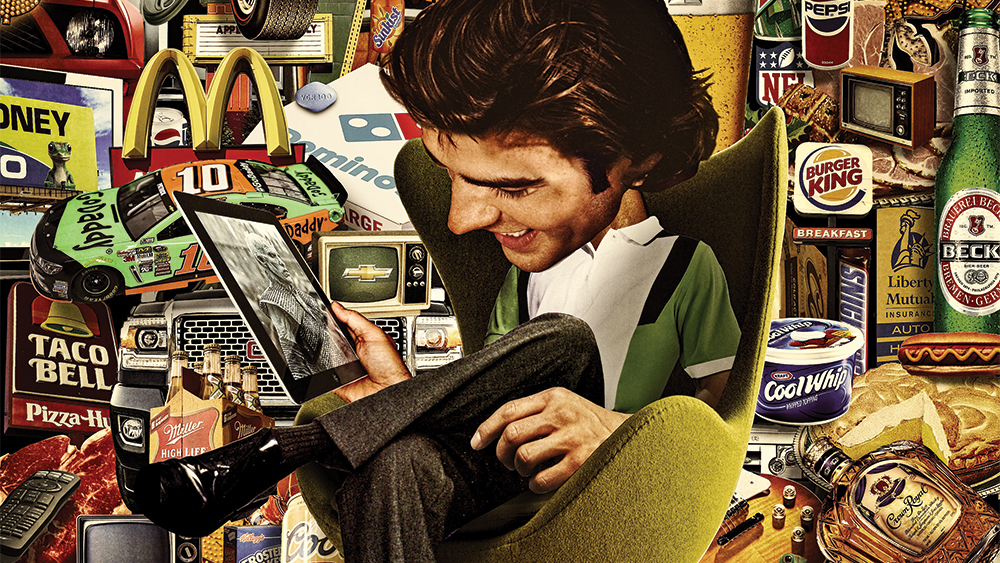

Indeed, such rules are already fraught. NBC, CBS, ABC and their boob-tube competitors have over the years taken in billions of dollars from Netflix, Amazon, Hulu and others to run TV ads that essentially tell TV viewers to stop watching TV, and start watching a streaming-video selection. You’ve seen them during Super Bowls: Ads for Amazon’s “Jack Ryan” or “Hanna,” or an eyebrow-raising spot for HBO’s “Game of Thrones” embedded into a commercial for Anheuser-Busch’s Bud Light. TV’s 2019 Emmys broadcast, for example, was jammed with commercials for the Netflix launch of “El Camino,” the movie based on the popular AMC series “Breaking Bad”; the first ad from Disney+ ; and handfuls of spots for new originals from Apple TV.

The dollars are alluring. Big entertainment and technology companies spent more than $1.2 billion on commercials placed across traditional media in the first quarter of 2023, according to data from Vivvix, a tracker of ad spending. In the fourth quarter of 2022, typically a time of swelled outlays to woo the holiday consumer, the companies spent more than $1.34 billion. The biggest spenders in the category over the past year have been Disney — which promotes Disney+ and Hulu — along with Paramount and Warner Bros. Discovery’s Max

There are plenty of other commercials that do the same thing, whether they hype new big screen TVs featuring connected-TV apps, or bespoke broadband services that let users surf through photos, music and new programs. TV hasn’t been shy about taking retailers’ ads for new high-tech gizmos that grant access to streaming favorites or spots for virtual reality gear that would presumably occupy the hours once spent watching TV.

Disney tried to throttle back on such stuff in 2019 when it told other streamers that it would not take their commercials unless they had a broader relationship, which could encompass advertsing, distribution or programing. At the time, Disney informed Netflix that it would not run its commercials on entertainment networks like ABC, Freeform and FX. Those policies remain in place, according to a person familiar with them. Disney still takes Netflix ads on ESPN.

One reason for prohibiting rival pitches? At present, some of the ad-supported streaming tiers aren’t able to meet the demands for reaching consumers mandated by big advertisers. Netflix’ new ad-supported product, which debuted in the U.S. in November, doesn’t have enough subscribers to generate the sizable crowds that blue-chip advertisers demand. So there’s no reason to take up commercials that might send subscribers to rival outlets. In fact, there’s little room for them. Netflix also doesn’t accept political ads and in some cases may not take commercials for sports betting at present, according to two people familiar with its policies.

At some point, ad blockades may make less sense. Earlier this week, for example, Netflix and Warner Bros. Discovery unveiled a deal that will put HBO series such as “Insecure,” “Ballers” and “Six Feet Under” on Netflix for an undisclosed window. Wouldn’t Warner Bros. Discovery benefit if Max took ads promoting those series on Netflix?

Some of the new-tech video giants may not be able to avoid such conflict, given the wide array of businesses they are building. Apple’s streaming service does not take traditional commercials, but its telecasts of Major League Soccer come with promotions for RBC Wealth Management, which struck a major partnership with MLS earlier this year. Would Apple, which backs the Apple Card and the Apple Pay service, consider these nods to a rival?

Companies may see threats to their business, but consumers probably do not, says Hanlon, the consultant. And if big media and tech conglomerates want to keep dollars flowing, these rules will likely get in the way. “I think it’s inevitable that the checkbook will win out” over other concerns, he adds.

News Source: Variety

Discover more from Rathergood

Subscribe to get the latest posts sent to your email.